what is suta tax california

SUTA is short for State Unemployment Tax Act. 2021 SUI tax rates and taxable wage base.

Is California Blowing It On Unemployment Reform News Almanac Online

State Disability Insurance SDI and Personal Income.

. SUTA dumping is a tax. State Unemployment Tax Act SUTA dumping is one of the biggest issues facing the Unemployment Insurance UI program. State Unemployment Tax Act Dumping.

The SUTA tax is the state version of the FUTA tax. While there will be an increase in the state disability insurance taxable wage base. The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay.

These benefits are provided to qualifying employees by the. If one of your employees ever. The California law requires employers that are caught illegally lowering their UI.

The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers. Once paid these taxes are placed into. Just as FUTA taxes fund federal unemployment programs SUTA taxes fund your states unemployment insurance program.

Unemployment Insurance UI and Employment Training Tax ETT are employer contributions. Californias unemployment taxable wage base is to be 7000 in 2022 unchanged from 2021. Once paid these taxes are placed into.

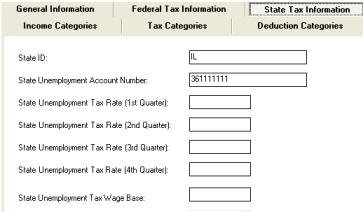

The State Unemployment Tax Act SUTA is a state version of the FUTA tax. California was one of the first states to enact legislation as a result of the federal SUTA Dumping Prevention Act. The state UI tax rate for new employers known in some states and.

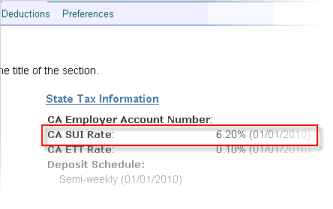

This tax is a payroll tax that businesses must pay to fund unemployment benefits. The state unemployment tax also called the state payroll tax or simply SUTA is a payroll tax you pay into your states unemployment benefits fund. According to the EDD the 2021 California employer SUI tax rates continue to.

This means that instead of funding the federal governments unemployment and benefits programs. The SUI taxable wage base for 2021 remains at 7000 per employee. California has four state payroll taxes.

The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers.

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Employers Hit By Unemployment Tax Hikes Sep 29 2011

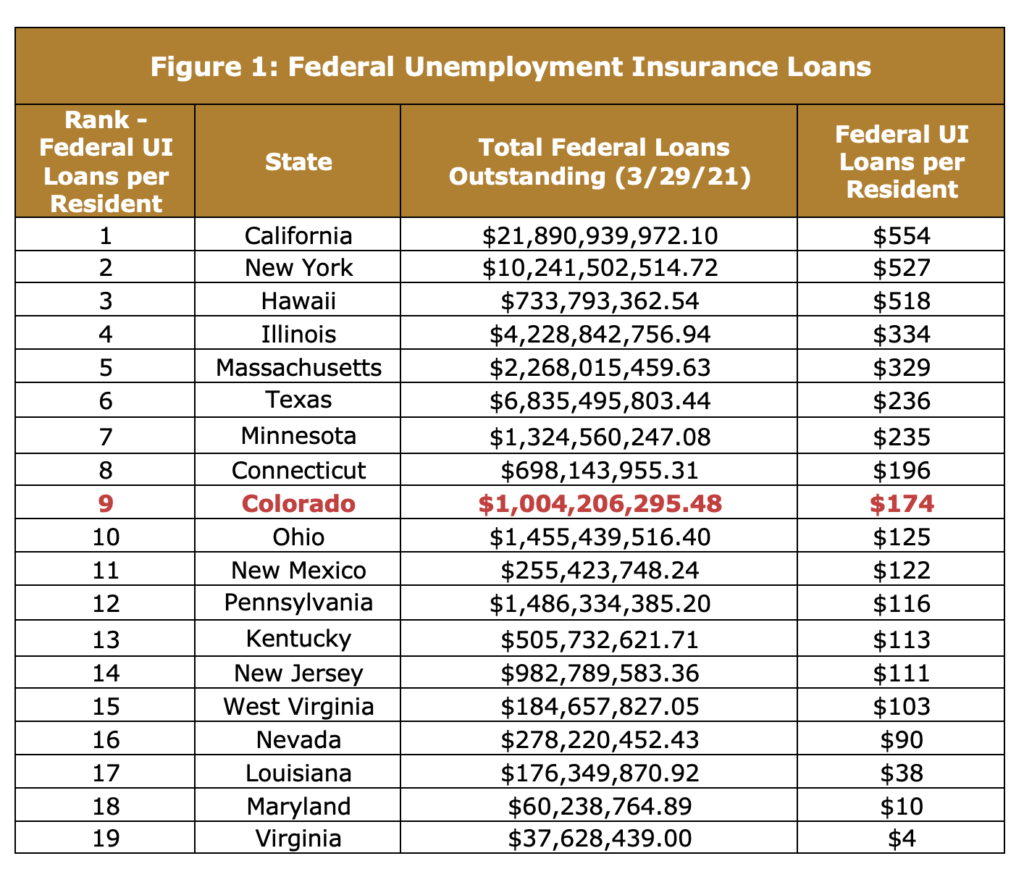

The State Of Colorado S Unemployment Insurance Trust Fund Common Sense Institute

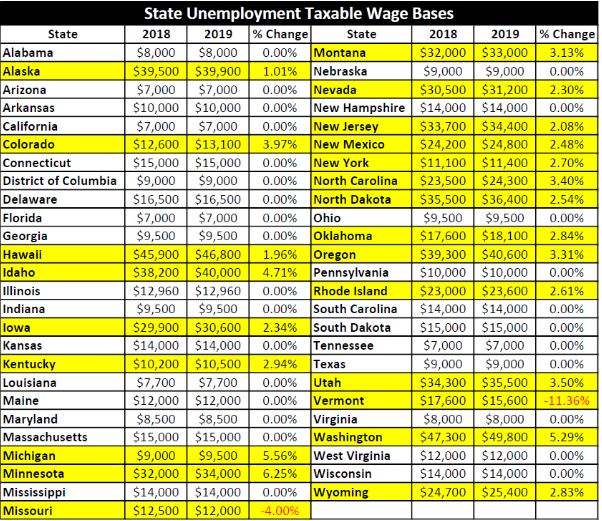

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

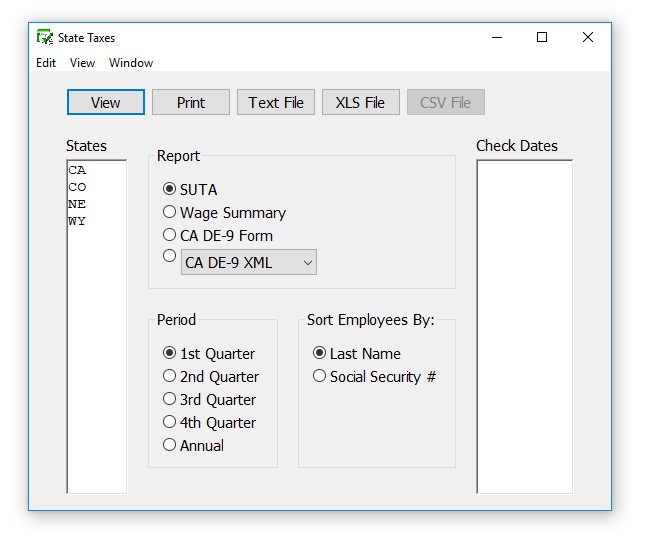

Payroll Software Solution For California Small Business

How Much Does An Employee Cost In California Gusto

Rising Payroll Taxes Coming To Shore Up California S Pandemic Depleted Ui Fund Calchamber Alert

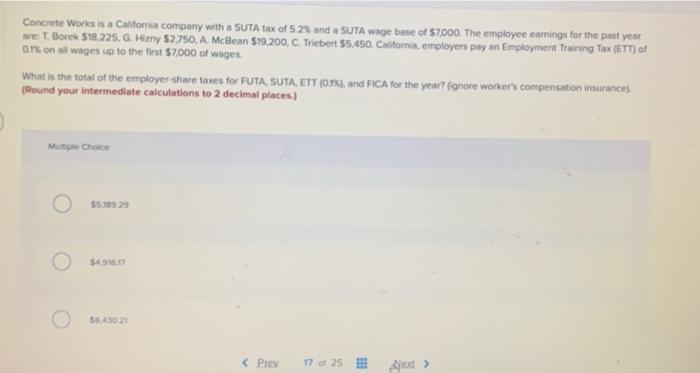

Concrete Works Is A California Company With A Suta Chegg Com

Update Suta And Ett Tax For Quickbooks Online Candus Kampfer

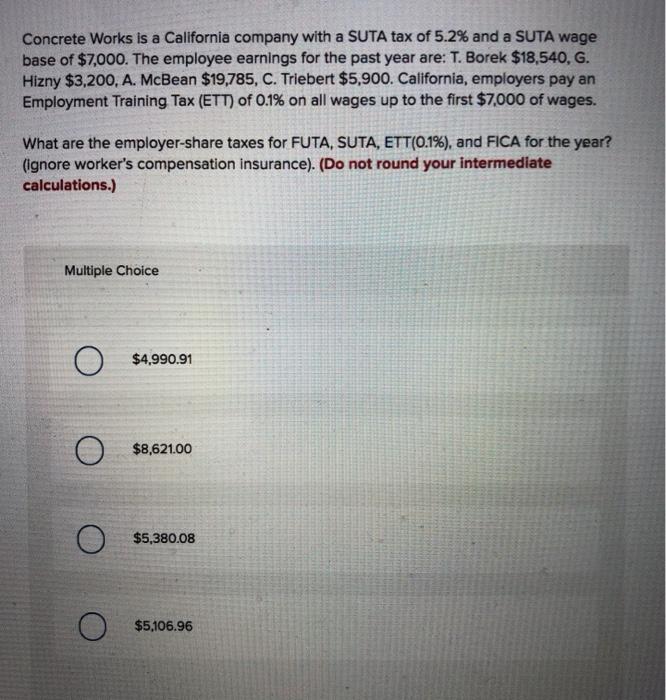

Solved Concrete Works Is A California Company With A Suta Chegg Com

1099 G Fill Online Printable Fillable Blank Pdffiller

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

I Want To Register For A California Employer Payroll Tax Account Number Youtube

Your Guide To Paying Taxes On California Unemployment Benefits Laist

What Is Sui State Unemployment Insurance Tax Ask Gusto